Landlords, beware of the troubles ahead

Written by Christian Bulpitt

Landlords have once again proven to be an easy target for the Government. The Autumn 2018 Budget delivered yet further blows to Landlords.

The main target are those individuals who own one or two rental properties. In many cases those affected are taxpayers who became accidental landlords through circumstances such as: divorce, separation, or death of a family member.

Currently the gain on such properties benefits from two important tax reliefs:

- PPR (Principal Private Residence) relief: the disposal of a main residence will be exempt from capital gains tax (CGT), providing the property has been the only or main residence throughout the period of ownership. The last 18 months of ownership is treated as a period of residence (whether the property is occupied or not). So, if you rent your property for 18 months before sale no CGT relates to that final period. The period is extended to 36 months if the property owner moves to a rest home.

- Lettings relief: when a property is let, a further CGT relief is available which deducts the lower of the following amounts from the chargeable gain:

- the amount of PPR relief

- £40,000

- the amount of gain relating to the let period.

Thus, where no PPR relief is available, there is no lettings relief.

HOWEVER

For property sales on or after 6 April 2020 these reliefs will be reduced.

The final period exemption for PPR will halve from 18 months to nine months. It will however retain to the 36 month period for those owners moving to a rest home.

Additionally, the letting relief will be restricted to only apply to situations where the tenant and landlord are in shared occupation. And it will not applied to the more common scenario where the landlord has moved out.

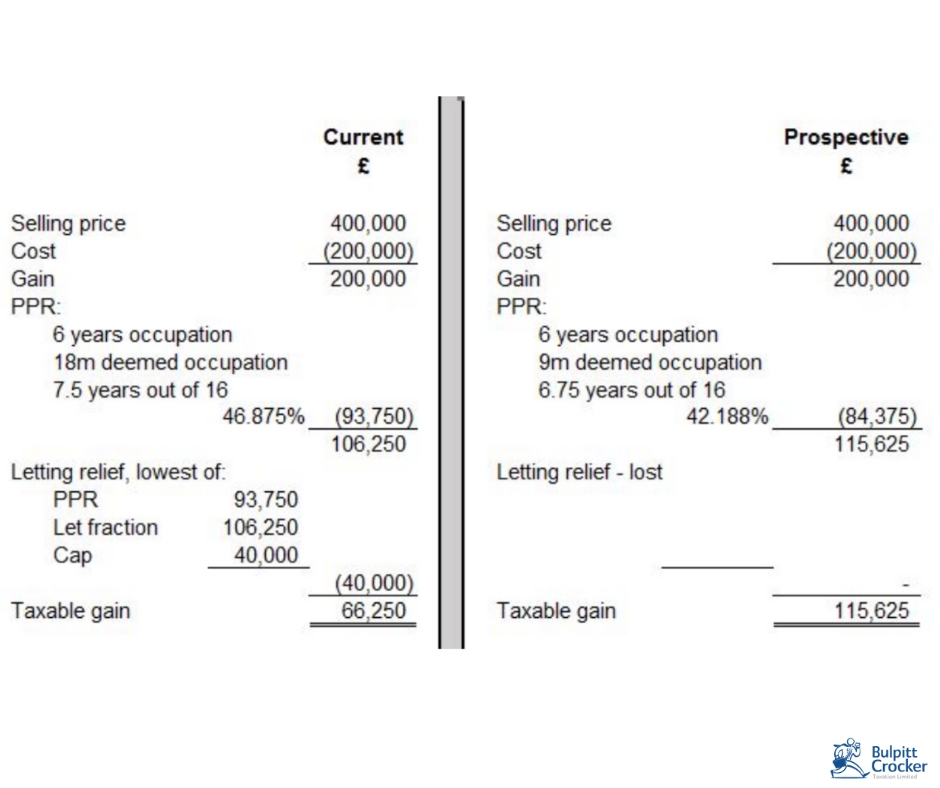

Please see the below an example, highlighting how these changes will affect you:

Mr John Smith bought a house in January 2005 for £200,000 and he occupied the property until December 2010. At which time he moved into his partners property. He rented out his old home until December 2020 and then sold for £400,000:

With the tax rates for Capital gains Tax being 18%/28% these changes can be quite costly.

If you are a higher or additional rate taxpayer this could increase the tax charge, upon the sale of the property by nearly £14,000.

If you are currently renting out your former home and are considering a disposal of the property within the next five years, do contact us for advice. That way you’ll be able to see how these prospective changes will impact your tax position, allowing you to make an informed decision.

And I wouldn’t wait too long. After all, its not what you earn, it’s what you keep.